-

Welcome to the ShrimperZone forums.

You are currently viewing our boards as a guest which only gives you limited access.

Existing Users:.

Please log-in using your existing username and password. If you have any problems, please see below.

New Users:

Join our free community now and gain access to post topics, communicate privately with other members, respond to polls, upload content and access many other special features. Registration is fast, simple and free. Click here to join.

Fans from other clubs

We welcome and appreciate supporters from other clubs who wish to engage in sensible discussion. Please feel free to join as above but understand that this is a moderated site and those who cannot play nicely will be quickly removed.

Assistance Required

For help with the registration process or accessing your account, please send a note using the Contact us link in the footer, please include your account name. We can then provide you with a new password and verification to get you on the site.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Investments

- Thread starter Ricky Otto

- Start date

Dave Smiths Love Child

Coach

- Joined

- Aug 13, 2005

- Messages

- 1,876

I only invest in stock RO, but good to see you making good gains, out of interest do you have to keep the investment for a number of weeks or can you sell straight away, just interested in the way it works, do you go through a broker or is it like an online bookies you invest with ie debit card then when you sell you ask for it to be put back

Good luck to you and hope it continues

Good luck to you and hope it continues

Ricky Otto

President⭐

I invest with a broker, Hargreaves lansdown. There is no minimum holding time but price you pay is always a little higher than current selling price plus there is a fee of £11.95 per trade so you usually have to wait a bit before you are in profit. I know people have mentioned other brokers on here where the fees are lower so may be worth looking around. I find it takes about 3 days to get your money after you cash it out

I only invest in stock RO, but good to see you making good gains, out of interest do you have to keep the investment for a number of weeks or can you sell straight away, just interested in the way it works, do you go through a broker or is it like an online bookies you invest with ie debit card then when you sell you ask for it to be put back

Good luck to you and hope it continues

Ricky Otto

President⭐

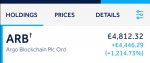

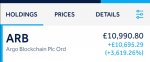

View attachment 13899 well that escalated quickly. My 1st 10 bagger ?

The gift that keeps giving

Attachments

Ricky Otto

President⭐

Very high risk imo given they are being sued by the SEC.Anyone have any insight into XRP

Holy Joe

Manager⭐⭐

- Joined

- Aug 8, 2005

- Messages

- 8,039

Interesting story about some Essex based traders in the oil market. Not sure if they will end up in prison or not....

The Essex Boys: How Nine Traders Hit a Gusher With Negative Oil

Over the course of a few hours on April 20, a guy called Cuddles and eight of his pals from the freewheeling world of London’s commodities markets rode oil’s crash to a $660 million profit.www.bloomberg.com

Looking like a court case in the US will happen.....

From the FT....

A US judge has allowed a case to proceed against UK traders accused of causing an unprecedented crash in oil futures markets after ruling that text messages between the group were sufficient to point towards a potential conspiracy. The proposed class-action lawsuit centres around trading on April 20 2020, when the price of benchmark West Texas Intermediate crude oil plunged below zero for the first time on record. Self-employed traders linked to Vega Capital London, a little-known commodities brokerage based in the Essex town of Benfleet, stand accused of making more than $700mn by flooding futures markets to drive the price lower. Mish International Monetary, a California rare coin dealer that says it lost money that day, alleges market manipulation and violations of antitrust laws. Its civil suit accuses the defendants of buying special “trading at settlement” (TAS) contracts, whose price would be fixed by that day’s settlement value, then conspiring to dump huge volumes of ordinary WTI contracts ahead of the expiry. Court documents released on Tuesday and first reported by Bloomberg show how the group — dubbed the Essex Boys — discussed trading strategies that day over WhatsApp. “I’m doing a fortune on TAS haha,” one of the traders is quoted as saying. “We pushed each other so hard for years for this one moment . . . And we f****** blitzed it boys,” said another. A third added: “Please don’t tell anyone what happened today lads.” US District Judge Gary Feinerman of Chicago gave the go-ahead for the case to progress, ruling that the allegations against eight of the 12 traders accused were plausible based on the communications, as well as on a “high degree of correlative trading”. The defendants, whose identities are protected by court order, deny the allegations and contend they are independent traders who were following market signals during a period of turmoil. Vega Capital could not be reached for comment. WTI futures on CME Group’s New York Mercantile Exchange had crashed by $56 a barrel to close at negative $37.63 as a shortage of physical storage space led investors to dump futures contracts rather than take delivery. The price recovered to around $10 the next day, allegedly giving the group its windfall. In the period immediately before WTI futures expired, the collective was dumping 153.5 contracts a minute and accounting for more than 30 per cent of total global market volume, the Mish lawsuit alleges. It notes an “extremely strong tendency” of between 96.2 per cent and 99.7 per cent for its trades to “move in the same direction at the very same time”. The Commodity Futures Trading Commission, the US regulator, analysed the WTI price plunge on April 20, 2020, but it did not draw conclusions as to the cause. Feinerman dismissed the case against Vega Capital and its owner, ruling that they were not party to the alleged conspiracy. Mish has until April 28 to challenge the judge’s decisions by amending its complaint.

davewebbsbrain

Webby⭐

Won the case. Ripple can move forward now and will soon be the world's biggest money transfer tool, cheaper and faster than Swift.Very high risk imo given they are being sued by the SEC.

The XRP price will rise over the next couple of years. Hopefully it will do a bitcoin and I will be able to retire

I have invested in XRP but am also mining Pi as a back up plan.

Ricky Otto

President⭐

It does look a good investment now ??Won the case. Ripple can move forward now and will soon be the world's biggest money transfer tool, cheaper and faster than Swift.

The XRP price will rise over the next couple of years. Hopefully it will do a bitcoin and I will be able to retire

I have invested in XRP but am also mining Pi as a back up plan.

Mad Cyril

The Fresh Prince of Belfairs⭐⭐

I have recently spoken to a financial advisor and wish I had done so ten years ago.

We are not in too bad shape but need to step up pension contributions. I dread to think how many people who from the outside appear successful are going to be in real trouble or are relying on inheritances which may be much smaller than they anticipate.

We are not in too bad shape but need to step up pension contributions. I dread to think how many people who from the outside appear successful are going to be in real trouble or are relying on inheritances which may be much smaller than they anticipate.

Holy Joe

Manager⭐⭐

- Joined

- Aug 8, 2005

- Messages

- 8,039

I have recently spoken to a financial advisor and wish I had done so ten years ago.

We are not in too bad shape but need to step up pension contributions. I dread to think how many people who from the outside appear successful are going to be in real trouble or are relying on inheritances which may be much smaller than they anticipate.

There's some good stuff on FIRE UK Facebook group about pension contributions/ISA mix etc to get the best tax efficiency when retired and when earning. I've probably got too much pension versus not enough ISA to retire now (I'm 49). Hopefully if stock markets are kind that may change in next couple of years.

We also have too much pension in my name versus in my wife's, so we're redirecting contributions to her pension a little as well. That will help tax efficiency in retirement - making sure we use both or our tax free allowances

Holy Joe

Manager⭐⭐

- Joined

- Aug 8, 2005

- Messages

- 8,039

There's some good stuff on FIRE UK Facebook group about pension contributions/ISA mix etc to get the best tax efficiency when retired and when earning. I've probably got too much pension versus not enough ISA to retire now (I'm 49). Hopefully if stock markets are kind that may change in next couple of years.

We also have too much pension in my name versus in my wife's, so we're redirecting contributions to her pension a little as well. That will help tax efficiency in retirement - making sure we use both or our tax free allowances

Also can use Guiide for planning - although if I recall it doesn't really consider couples situations.

united we stand

Life President⭐

I massively advocate speaking to a financial advisor.I have recently spoken to a financial advisor and wish I had done so ten years ago.

We are not in too bad shape but need to step up pension contributions. I dread to think how many people who from the outside appear successful are going to be in real trouble or are relying on inheritances which may be much smaller than they anticipate.

I’m 54 and had my “lightbulb moment” 10 years ago. I have worked for investment banks and financial institutions all my life and am good with numbers, but seeing a pensions guy is still the best financial move I ever made.

I just wish the government stopped moving the goal posts!

I also totally agree with the comment on people being in trouble in the future. Most people have absolutely no idea and never think about it. Many I speak to think that “my firm pays in 10% so I will be ok”.

Mad Cyril

The Fresh Prince of Belfairs⭐⭐

I massively advocate speaking to a financial advisor.

I’m 54 and had my “lightbulb moment” 10 years ago. I have worked for investment banks and financial institutions all my life and am good with numbers, but seeing a pensions guy is still the best financial move I ever made.

I just wish the government stopped moving the goal posts!

I also totally agree with the comment on people being in trouble in the future. Most people have absolutely no idea and never think about it. Many I speak to think that “my firm pays in 10% so I will be ok”.

The average UK pension pot at retirement is somewhere between £70-£80k.

There are various ways you can take a pension but this equates to an annuity of maybe a couple of thousand a year if you are lucky which on top of a state pension gives you around £11k a year.

united we stand

Life President⭐

Agreed, and the majority of people have less than that.The average UK pension pot at retirement is somewhere between £70-£80k.

There are various ways you can take a pension but this equates to an annuity of maybe a couple of thousand a year if you are lucky which on top of a state pension gives you around £11k a year.

As you said there are now many ways to take sip. And taking an annuity is dumb in my opinion.

Are a persons spending requirements the same at the age they retire as at 80 years old- no IMO.

I massively advocate speaking to a financial advisor.

I’m 54 and had my “lightbulb moment” 10 years ago. I have worked for investment banks and financial institutions all my life and am good with numbers, but seeing a pensions guy is still the best financial move I ever made.

I just wish the government stopped moving the goal posts!

I also totally agree with the comment on people being in trouble in the future. Most people have absolutely no idea and never think about it. Many I speak to think that “my firm pays in 10% so I will be ok”.

What was your takeaway from speaking to the financial advisor?

Are we just talking about things like the rule of thumb being contributing 0.5% of salary for every year old you are when you start contributing (ie 12% if you’re 24)?

Supershrimper

First XI⭐

- Joined

- Feb 14, 2010

- Messages

- 3,225

Thats astonishing. I have £120k in mine and i've been with this company for 15 years. I'm only 39 so quite a few years to go before I retire just yet. I've always paid into a pension though but beenlucky with the amounts the companies also invest.. First job at the council i paid in. I didn't miss the money I paid in as I never had it coming into my bank account for me to spend.The average UK pension pot at retirement is somewhere between £70-£80k.

There are various ways you can take a pension but this equates to an annuity of maybe a couple of thousand a year if you are lucky which on top of a state pension gives you around £11k a year.

Looking at starting some investments this year. LISA probably, just something simple through a platform. Nothing fancy. Something as a little thing to keep me aware of what the markets are doing.

Last edited:

Tommy2holes

Life President⭐

- Joined

- Jan 21, 2007

- Messages

- 11,518

Ive only just started investing in Crypto.

Hopefully it will reap some kind of reward at some point.

Hopefully it will reap some kind of reward at some point.

Mad Cyril

The Fresh Prince of Belfairs⭐⭐

What was your takeaway from speaking to the financial advisor?

Are we just talking about things like the rule of thumb being contributing 0.5% of salary for every year old you are when you start contributing (ie 12% if you’re 24)?

My takeaway is those that stretched themselves to buy property in the 90s are laughing and that those days are never coming back.

I have mixed feelings about property as an investment but I am not so pious as to regret not being able to grab a slice of the pie.

ShrimperZone - Player Sponsorship